As we are approaching the final quarter of the current financial year, tax planning will be one of the most important priorities for many tax payers. Section 80C of Income Tax Act 1961, allows investors to claim deductions from their taxable incomes by investing in certain eligible schemes. In this blog post, we will discuss 5 reasons why you should invest in tax saving mutual fund schemes referred to as Equity Linked Saving Schemes (ELSS), and the Systematic Investment Plan (SIP)offered by them. In this scenario, you would hear terms such as tax saving SIP, 80C mutual funds and ELSS SIP in varying frequency, as people try to find the best option to limit their tax outgo and build their wealth. Indeed, saving on tax is the predominant focus for every earning individual, because none of us enjoy seeing our money being deducted in the form of tax. If you are also wondering about tax saving SIP and 80C mutual funds, you are in the right place and, most importantly, you are not alone.

Reduce your tax obligations for the current financial year

The most obvious reason for making 80C investments is tax savings schemes. You can claim up to Rs. 150,000/- deduction from your gross taxable income by investing an equivalent amount in ELSS or other eligible 80C schemes; you can save up to Rs. 46,800/- in taxes (for investors in the highest tax bracket) every year. SIP is a disciplined way of making tax saving investments throughout the year to achieve maximum tax savings.

Create wealth over a long investment tenor

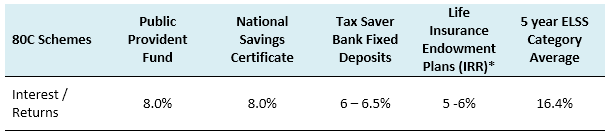

ELSS mutual funds are usually the best performing 80C investments in the long term. These schemes are essentially diversified equity mutual funds, which invest in equity and equity related securities. While ELSS investments are subject to market risks, historical data shows that equity is the best performing asset class in the long term. Nifty 100, which is the index of 100 largest stocks by market capitalization (large cap stocks), has given 12.6% annualized returns in the last 5 years, much higher than other asset classes like fixed income and gold (source: Advisorkhoj Research). Further ELSS mutual funds are managed by professional and skilled fund managers. The table below shows the interest paid by different 80C investment schemes and historical returns of ELSS category.

Maximum Liquidity

ELSS offers the maximum liquidity amongst all 80C investment options. PPF has a tenor of 15 years with very limited liquidity in the interim. Minimum investment tenor of all non-ELSS 80C schemes is 5 years. ELSS mutual funds have a lock-in period of only 3 years. Your money is not locked up for long periods of time in ELSS and you have the option of redeeming your investment partially or fully after the lock-in period. When investing in ELSS through the SIP route, investors should remember that each SIP instalment will be locked in for 3 years and should plan accordingly.

Tax Advantage

Investment proceeds of some 80C investments like PPF are tax free, but interest paid by some 80C investments are taxed as per the income tax rate of the investor. Till the beginning FY 2019, ELSS capital gains / profits were tax free but a change in taxation was introduced in this year’s Union Budget. Capital gains of up to Rs 1 Lakh in ELSS mutual funds will be tax exempt. Capital gains in excess of Rs 1 Lakh will be taxed at 10%. Incidence of tax in ELSS investments arises only at the time of redemption and not during the term of the investment. Even with the introduction of the capital gains tax, ELSS remains one of the most tax efficient 80C investment options.

Convenience and Flexibility

ELSS offers investors the convenience of investing through SIP mode in which you can invest fixed amounts every month (or any other frequency) for tax savings. SIP not only helps investors stay disciplined, it can also help them get higher returns through Rupee Cost Averaging. ELSS SIPs offers a lot of flexibility. Unlike PPF or life insurance plans, there are no penalties or policy suspensions, in the event of missed payments in ELSS SIPs. You can stop and restart your SIPs at any time. However, if you miss 3 consecutive SIP instalments due to insufficient funds in your bank, your SIP will be cancelled and you will have to make a fresh application to restart your SIP. Therefore, you should ensure that there is always sufficient balance in your bank account on SIP dates.

Should you invest in tax saving mutual fund SIPs?

Investing in Tax Saving Mutual Fund SIPs (Systematic Investment Plans) can be a smart choice for individuals looking to combine wealth creation with tax efficiency. These funds, primarily represented by Equity Linked Savings Schemes (ELSS), provide tax benefits under Section 80C of the Income Tax Act, making them a preferred option for many Indian investors. By choosing a Tax Saving Mutual Fund, you can not only save taxes but also participate in the potential growth of equity markets over time.

One of the key advantages of Tax Saving Mutual Fund investments is the short lock-in period of just three years, which is significantly lower compared to other tax-saving instruments like Public Provident Fund (PPF) or Fixed Deposits (FDs). This feature allows investors to maintain liquidity while still enjoying the benefits of tax-saving investments. Additionally, ELSS funds typically offer higher returns over the long term compared to traditional instruments, though they come with a level of market risk. For those considering a disciplined approach, tax saver SIP plans are an ideal option. SIPs enable investors to make regular contributions, reducing the burden of a lump sum investment. By investing in tax saver SIP plans, you benefit from rupee cost averaging and the power of compounding, which can enhance your returns over time. Moreover, these plans make tax-saving investments more accessible to individuals with varying income levels.

An ELSS SIP is especially suitable for first-time investors, as it allows gradual exposure to equity markets while offering tax benefits. It is important to assess the performance of funds and align your investment with your financial goals and risk tolerance. By opting for tax saver SIP plans, you not only optimise your tax liabilities but also build a robust investment portfolio.

Indeed, Tax Saving Mutual Fund investments, especially through ELSS SIP, offer an effective way to save taxes and grow wealth in the Indian context.

Conclusion

In this post, we discussed why ELSS investments through SIPs is one of the best tax saving investments. It not only helps you save taxes, but also creates wealth for investors with high risk appetite. ELSS is also the most liquid and convenient investment options under Section 80C considering the SIP route. Investors should consult with their financial advisors if ELSS schemes are suitable for their tax saving purposes.

#WiseWith Edelweiss

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a onetime KYC process. Investor should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF and procedure to lodge/redress any complaints, visit -https://www.edelweissmf.com/kyc-norms

MUTUAL FUND INVESTMENT ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Trending Articles

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.