In life, often when you come at a crossroad you need to choose between one path or another. Each path has its own benefits and disadvantages but you choose the path that works best for you. Similarly, when it comes to making mutual fund investments, you can choose to invest via a direct plan or a regular plan. Each plan is different and has it own unique advantages and knowing them will help you decide what route works best for you.

First, lets understand the definition of each plan.

- Direct plan:You can buy this directly from the asset management company (AMC) and do not need to go through an intermediary. All you need to do is visit either the AMC website or visit the AMC or the registrar’s office.

- Regular plan:You can buy this through any mutual fund distributor for a certain fee that is paid to intermediary.

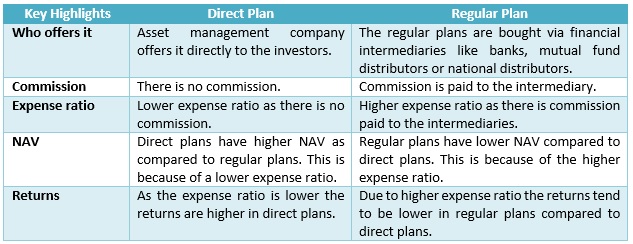

A plan that is offered directly to you by the asset management company is a direct plan. The plan that you purchase through an intermediary for a certain fee is called a regular plan. The main differences between direct and regular plans are mentioned below:

Choosing between direct and regular

The direct plan has lower cost and higher returns as compared to a regular plan. Over a longer time frame the return difference increases. This is largely due to the lower expense and compounding effect over the long-term. However, cost should not be your only consideration.

As easy it may sound you would definitely need to have some investment knowledge to invest in direct plans offered bymutual funds. If you invest in the wrong fund you may end up losing money or may not be able to achieve your financial goals. Further, you would also need to constantly monitor your investment portfolio and strive to make the right decision at the right time. To ensure that the investments are in the right buckets and are well-aligned with your goals and risk-return profile, it might be better to seek professional advice. Your financial advisor will look at various parameter like risk appetite, return requirements, and investment time frame and then suggest the right investment scheme. Thus, while cost is one thing that you should look at, the other things like access to the right advice and investment guidance are equally importance.

While you have the freedom to choose between a regular and direct plan, you must treat this freedom with responsibility. This means that you need to be aware of both the approaches and then select the one that suits you best.

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a onetime KYC process. Investor should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF and procedure to lodge/redress any complaints, visit - https://www.edelweissmf.com/kyc-norms

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

Trending Articles

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.