How often do you find yourself in a situation wherein you have to choose between two things? Be it clothes, foods, movies, properties, or even investments, making a choice is not easy. However, analysing both options always helps.

Are you confused about whether to put your money in fixed deposits (FD) or mutual funds? Here’s a guide that will ease your dilemma of FD vs Mutual Fund.

Know all about FDs in India

Before decoding the FD vs mutual fund equation, let us take a look at what fixed deposits are. Fixed deposits, also known as term deposits, are popular investment instruments which are offered by banks and financial institutions in an attempt to offer a secure and stable investment option for risk-averse investors. Such individuals usually focus on preserving their capital while earning a fixed rate of return over a specific period of time and the fixed deposit vs mutual fund equation may seem to favour the former for such investors.

In a fixed deposit, an investor deposits a certain amount of money with a bank or financial institution for a predetermined period, known as the tenure, which may range from a few months to several years. During this period, the deposited amount earns a fixed interest rate, which is agreed upon at the time of opening the fixed deposit account. Floating rate FDs will offer altering interest, depending on the repo rate mandated by the Reserve Bank of India.

In the mutual fund vs fixed deposit equation, we must also consider the advantages of FDs, such as their low risk and the flexible interest payout option. Many investors consider FDs safe investments because the principal amount is protected and guaranteed by the bank or financial institution. Further, the interest rates on fixed deposits are typically higher than those offered by savings accounts, making them an attractive choice. FDs also offer flexibility in terms of interest payout options and you can pick either periodic or as a lump sum withdrawal.

What are debt mutual funds?

Now let us look at debt mutual funds as we try to decode the mutual fund vs fixed deposit conundrum. Considering the question of fd vs mutual fund, debt mutual funds are investment vehicles that primarily invest in fixed-income securities such as government bonds, corporate bonds, treasury bills, money market instruments, and other debt instruments.

While the biggest differentiator in fixed deposit vs mutual fund is the underlying safety, debt mutual funds are also suitable for investors seeking regular income and capital preservation, given their lower risk when compared to equity investments. These funds aim to generate income through interest payments and capital appreciation from the underlying debt instruments, with the risk associated depending on the credit quality and interest rate movements of the underlying securities.

A key advantage of debt mutual funds, in the fd vs mutual fund consideration, is their potential for generating stable returns. These funds tend to be less volatile compared to equity mutual funds, making them a suitable option for conservative investors or those with a shorter investment horizon. Another benefit of debt mutual funds, when comparing fixed deposit vs mutual fund, is their liquidity. Unlike FDs, debt funds can be bought or sold at any time, providing investors with the flexibility to access their funds when needed. This makes them a suitable choice for individuals who require more liquidity in their investments. Additionally, debt mutual funds offer tax advantages over traditional fixed deposits, with investments held for more than three years being subject to long-term capital gains tax, which is typically lower than the income tax on interest earned from fixed deposits.

Understanding how fixed deposits and debt mutual funds in India work

When you hear the word fixed deposits, you instantly think of banks. However, you can start a fixed deposit even with non-banking financial companies. So, what is a fixed deposit? It is an investment instrument that allows you to invest a lumpsum amount for a fixed tenure to earn returns at a fixed interest rate.

You know that mutual funds pool the money from different investors and invest in different securities. Debt mutual funds particularly invest in fixed-income securities such as debentures, corporate bonds, etc.

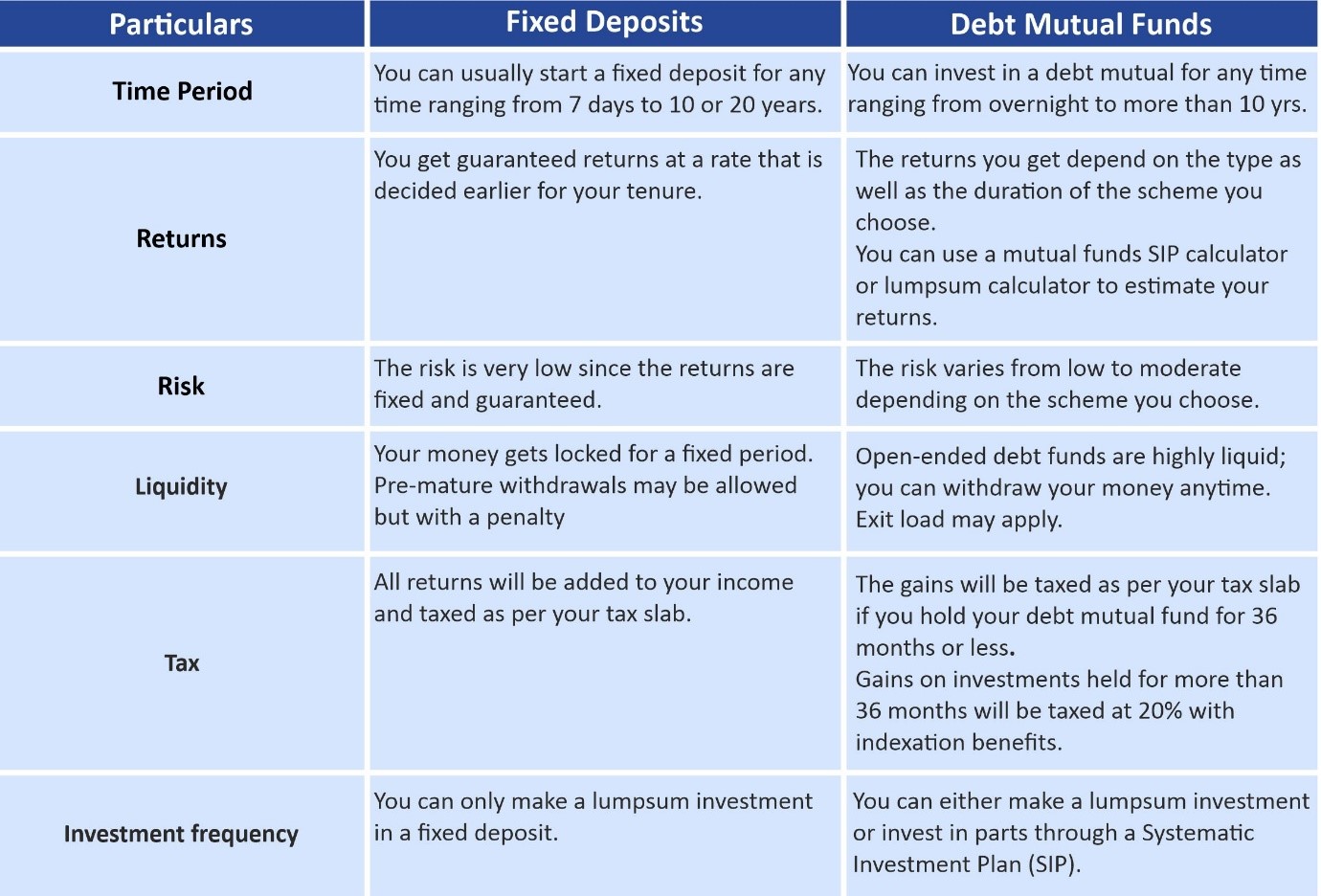

FD vs Mutual Funds – Comparing the two

Reasons that make debt mutual funds better than fixed deposits

- Liquidity: Open-ended debt mutual funds can be suitable for emergency needs too since you can redeem your money anytime. But the same flexibility is not available with FDs.

- Taxation: There is no difference in the taxation of accrued interest on FDs and short-term capital gains on debt mutual funds – Both are taxed as per your income slab. But long-term debt investments can be more tax-efficient, especially if you fall in the tax brackets higher than 20%.

- Returns: In the case of FDs, the return rate is fixed. Debt funds have the potential to deliver higher returns than FDs.

To sum it up

While FDs may be more common when it comes to investing savings, debt funds are far more beneficial. They are safer mutual funds, tend to be more tax efficient, and may generate better returns.

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a onetime KYC process. Investor should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF and procedure to lodge/redress any complaints, visit - https://www.edelweissmf.com/kyc-norms

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATEDDOCUMENTS CAREFULLY.

Trending Articles

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.