Plan your retirement blockbuster picture

In life, all roads lead to retirement. Which is why when we reach that part of our life's journey, we must ensure that the rest of the path is easy and comfortable. Unfortunately, when people are at the cusp of starting their career, they find it difficult to see what their life might look like post retirement. Retirement seems like something that is in the distant future. After all, they have only just started earning. Most of us are so busy living in the present that we forget to plan for the future. However, one would be well advised to shed their myopic view and adopt a more holistic perspective to saving and life planning. There is a fine line between saving and saving wisely. The latter entails listing out your goals and aspirations and investing accordingly.

The ultimate investment goal should not just be retirement. It should be about having the financial security to retire peacefully and fulfil post-retirement goals. To prepare for your golden years, you must start now.

Invest and plan for your retirement today so that you have the resources to meet your goals in your golden years.

Prepare for the road ahead by following simple steps to retirement planning.

Goal determination

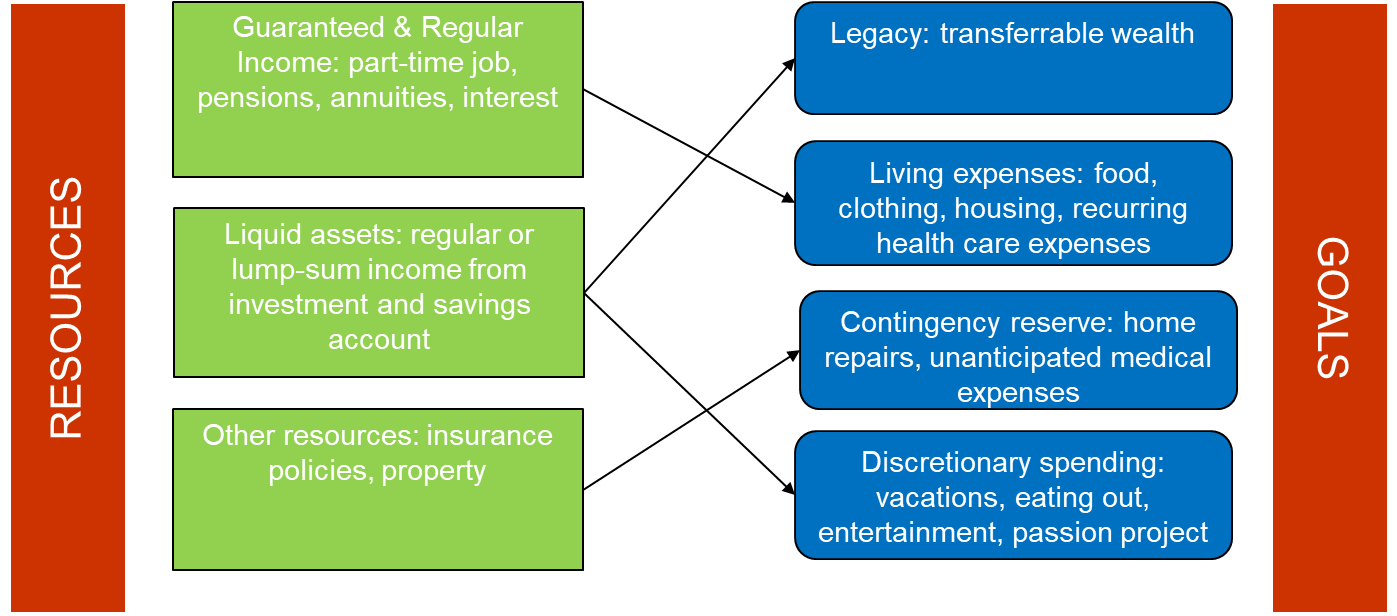

Saving for retirement is not actually a goal. How you envision your retired life and the lifestyle that you wish to maintain post retirement is a goal. Post retirement, there are certain needs that must be fulfilled on an ongoing basis while there are others that come up sporadically. The regular outflows would usually relate to your living and extracurricular expenses. Additionally, one must keep a contingency reserve for unforeseen expenses and also plan for legacy transfers. This is also an opportunity to plan for & pursue passion projects. Maybe you have always dreamed of producing a movie but have never had the time or money. If planned properly, retirement could be the right time for this.

Be cognizant of risks

Risk is ubiquitous in investing. However, as we approach retirement and then post retirement, our ability to absorb risk usually declines. In the retirement phase, we are largely dependent upon our savings and investments. It is for this reason that we must be cognizant of the risks that threaten our post-retirement financial stability. There is always a risk that the market value of your investments would fall or that you might not be able to keep up with your medical expenses. Additionally, there is also the risk that you might outlive your savings. These and a few other risks need to be taken into consideration at the time of retirement planning.

Take stock of your resources

Take an inventory of your present and anticipated future assets and accordingly arrive at a size for your resource pool. Things like your guaranteed income from a part-time job or pension, liquid assets and other sources like property or insurance policy will contribute to this resource pool.

Develop a plan

Create a long-term strategy that is an accurate combination of your highest-priority goals, biggest risk factors and available resources. Align your resources with your goals.

Achieve financial security

Achieving financial security in retirement is not an easy task. It is imperative that every individual takes stock of their personal circumstances to arrive at the “right fit” financial plan.

Trending Articles

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.