Edelweiss Banking & PSU Debt Fund

An open ended debt scheme predominantly investing in Debt Instruments of Banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

Data as on 31st January, 2025

| Investment Objective : The investment objective of the Scheme is to generate returns commensurate with risks of investing in a portfolio of Debt Securities and Money Market Instruments issued by Banks, Public Sector Undertakings, Public Financial Institutions, entities majorly owned by Central and State Governments and Municipal Bonds. However, there can be no assurance that the investment objective of the scheme will be realized. |

|

| Inception Date | 13-Sep-13 |

| Benchmark | CRISIL Banking & PSU Debt A‐II Index (Tier1), Nifty Banking & PSU Debt Index - A-III (Tier2) |

| Fund Managers Details | Mr. Dhawal Dalal Experience 26 years Managing Since 26-Nov-16 Mr. Rahul Dedhia Experience 14 years Managing Since 23-Nov-21 |

| Minimum Investment Amount | Rs. 100 per application and in multiples of Re. 1/- thereafter. |

| Additional investment amount | Rs. 100 per application and in multiples of Re. 1/- thereafter. |

| Exit Load | Nil |

| Total Expense Ratios~: | Direct Plan 0.70% Regular Plan 0.39% |

| Month End AUM |

Rs. 269.71 Crore

|

| Monthly Average AUM |

Rs. 268.82 Crore

|

| Direct Plan IDCW Option |

18.4155

|

| Direct Plan Growth Option |

24.5462

|

| Direct Plan Monthly IDCW Option |

10.9179

|

| Direct Plan Weekly IDCW Option |

10.5594

|

| Direct Plan IDCW Fortnightly |

14.5590

|

| Regular Plan IDCW Option |

17.6306

|

| Regular Plan Growth Option |

23.7183

|

| Regular Plan Monthly IDCW Option |

11.1622

|

| Regular Plan Weekly IDCW Option |

10.1541

|

| Regular Plan IDCW Fortnightly |

14.0955

|

| (as on January 31, 2025) |

|

Name of Instrument

|

Rating

|

% to Net Assets

|

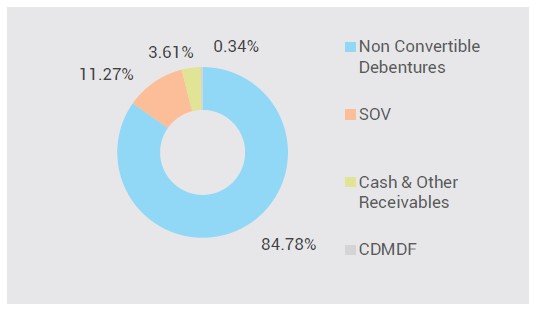

| Debt | 95.71% | |

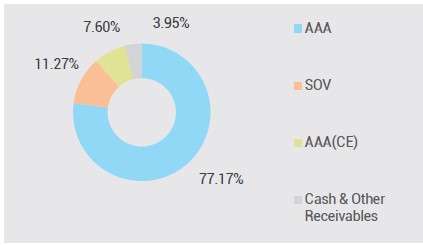

| 7.18% GOVT OF INDIA RED 14-08-2033 | SOV | 9.53% |

| 8.41% HUDCO NCD GOI SERVICED 15-03-2029 | ICRA AAA | 7.74% |

| 7.41% IOC NCD RED 22-10-2029 | FITCH AAA | 7.48% |

| 7.48% IRFC NCD RED 13-08-2029 | CRISIL AAA | 7.48% |

| 7.03% HPCL NCD RED 12-04-2030 | CRISIL AAA | 7.34% |

| 7.64% FOOD CORP GOI GRNT NCD 12-12-2029 | CRISIL AAA(CE) | 7.14% |

| 8.85% REC LTD. NCD RED 16-04-2029 | CRISIL AAA | 5.85% |

| 7.49% NHAI NCD RED 01-08-2029 | CRISIL AAA | 4.88% |

| 8.83% EXIM BK OF INDIA NCD RED 03-11-29 | CRISIL AAA | 3.94% |

| 8.27% NHAI NCD RED 28-03-2029 | CRISIL AAA | 3.85% |

| 8.12% NHPC NCD GOI SERVICED 22-03-2029 | CARE AAA | 3.85% |

| 8.13% NUCLEAR POWER CORP NCD 28-03-2029 | CRISIL AAA | 3.84% |

| 8.09% NLC INDIA LTD NCD RED 29-05-2029 | ICRA AAA | 3.82% |

| 7.34% POWER GRID CORP NCD 13-07-2029 | CRISIL AAA | 3.74% |

| 7.41% POWER FIN CORP NCD RED 25-02-2030 | CRISIL AAA | 3.72% |

| 7.50% REC LTD. NCD RED 28-02-2030 | CRISIL AAA | 2.99% |

| 8.40% NUCLEAR POW COR IN LTD NCD28-11-29 | CRISIL AAA | 1.95% |

| 8.24% NABARD NCD GOI SERVICED 22-03-2029 | CRISIL AAA | 1.92% |

| 7.10% GOVT OF INDIA RED 18-04-2029 | SOV | 1.89% |

| 7.04% GOVT OF INDIA RED 03-06-2029 | SOV | 1.88% |

| 8.79% INDIAN RAIL FIN NCD RED 04-05-2030 | CRISIL AAA | 0.48% |

| SBI CDMDF--A2 | 0.36% | |

| 8.7% LIC HOUS FIN NCD RED 23-03-2029 | CRISIL AAA | 0.04% |

| Cash & Other Receivables | 4.29% | |

| Cash & Cash Equivalent | 3.72% | |

| TREPS_RED_03.02.2025 | 0.57% | |

| Grand Total | 100.00% |

|

Yield to maturity (YTM)

|

7.16%

|

|

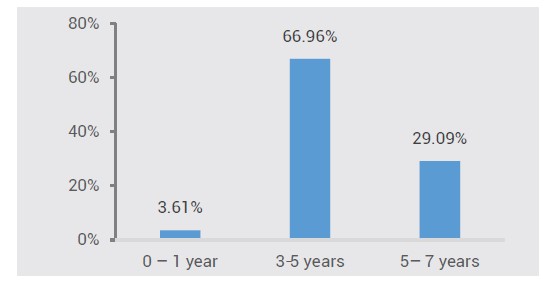

Modified Duration

|

3.84 years

|

|

Average Maturity

|

4.92 years

|

|

Macaulay Duration

|

4.06 years

|

| Period | Scheme - Regular Plan |

Tier 1 Benchmark (CRISIL Banking & PSU Debt A‐II Index)** |

Tier 2 Benchmark (Nifty Banking & PSU Debt Index - A-III) |

Additional Benchmark (CRISIL 10 year Gilt Index) |

||||

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

|

| 1 Year | 8.14% |

10,816 |

7.43% |

10,745 |

7.42% |

10,744 |

9.77% |

10,980 |

| 3 Years | 6.17% |

11,968 |

6.12% |

11,951 |

5.72% |

11,819 |

6.62% |

12,121 |

| 5 Years | 6.89% |

13,957 |

6.35% |

13,607 |

6.17% |

13,496 |

5.77% |

13,244 |

| 10 Years | 7.46% |

20,558 |

7.35% |

20,338 |

7.06% |

19,788 |

6.55% |

18,868 |

| Since Inception | 7.88% |

23,718 |

7.99% |

24,014 |

7.58% |

22,996 |

6.95% |

21,507 |

Past performance may or may not be sustained in future and

should not be used as a basis for comparison with other investments.

Notes:

1. 'Compounded annualized for above 1 year.'

2. Different plans shall have different expense structure. The performance details provided herein are of Regular Plan of Edelweiss Banking & PSU Debt Fund. Returns are for Growth

Option only. Since Inception returns are calculated on Rs. 10/- invested at inception of the scheme. In case the start/end date is non business day, the NAV of previous day is used

for computation.

3. The scheme is currently managed by Dhawal Dalal (managing this fund from November 26, 2016) and Rahul Dedhia (managing this fund from

November 23, 2021). Please Click here for name of the other schemes

currently managed by the Fund Managers and relevant scheme for performance.

4. ** With effect from 12th March 2024, the TIER 1 Benchmark for Edelweiss Banking & PSU Debt Fund changed from Nifty Banking & PSU Debt Index to CRISIL Banking & PSU Debt

A II Index.

5. For SEBI prescribed standard format for disclosure of Portfolio YTM for Debt Schemes please refer

For performance of Direct Plan please

click here

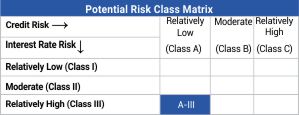

This Product is suitable for investors who are seeking*:

- Income Over short to medium term

- Investment in Debt Securities and Money Market Instruments issued by Banks, PSUs and PFIs

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Tier 1 Benchmark: CRISIL Banking and PSU Debt A‐II Index

Tier 2 Benchmark: Nifty Banking & PSU Debt Index - A-III