Edelweiss Multi Asset Allocation Fund

An open-ended scheme investing in Equity, Debt, Commodities and in units of REITs & InvITs.

Data as on 31st October, 2024

| Investment Objective : To provide the investors an opportunity to invest in an actively managed portfolio of multiple asset classes. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. |

|

| Inception Date | 23-Jun-23 |

| Benchmark | Nifty 500 TRI (40%) + CRISIL Short Term Bond Fund Index (50%) + Domestic Gold Prices(5%) + Domestic Silver Prices(5%). |

| Fund Managers Details | Equity Portion: Debt Portion: Overseas & Commodities Portion: |

| Minimum Investment Amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter |

| Additional investment amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter |

| Exit Load |

|

| Total Expense Ratios~: | Regular Plan 0.71% Direct Plan 0.40% |

| Month End AUM |

Rs. 1,350.06 Crore

|

| Monthly Average AUM |

Rs. 1,301.05 Crore

|

| Regular Plan Growth Option |

11.0589

|

| Regular Plan IDCW Option |

11.0589

|

| Direct Plan Growth Option |

11.1065

|

| Direct Plan IDCW Option | 11.1065 |

| (as on October 31, 2024) |

| (Quantity fully hedged against derivative) | ||

|

Name of Instrument

|

Industry

|

% to Net Assets

|

| Tata Consultancy Services Ltd. | Information Technology | 2.75% |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | 2.25% |

| HDFC Bank Ltd. | Financial Services | 2.10% |

| Hindustan Aeronautics Ltd. | Capital Goods | 1.68% |

| Adani Enterprises Ltd. | Metals & Mining | 1.61% |

| Coal India Ltd. | Oil, Gas & Consumable Fuels | 1.32% |

| Bharti Airtel Ltd. | Telecommunication | 1.12% |

| The Federal Bank Ltd. | Financial Services | 0.88% |

| Bajaj Finance Ltd. | Financial Services | 0.75% |

| Shriram Finance Ltd. | Financial Services | 0.68% |

| Oil & Natural Gas Corporation Ltd. | Oil, Gas & Consumable Fuels | 0.65% |

| Axis Bank Ltd. | Financial Services | 0.62% |

| Vodafone Idea Ltd. | Telecommunication | 0.62% |

| REC Ltd. | Financial Services | 0.59% |

| Cummins India Ltd. | Capital Goods | 0.56% |

| Mahindra & Mahindra Ltd. | Automobile & Auto Components | 0.51% |

| Kotak Mahindra Bank Ltd. | Financial Services | 0.51% |

| Indus Towers Ltd. | Telecommunication | 0.51% |

| ITC Ltd. | Fast Moving Consumer Goods | 0.50% |

| Aurobindo Pharma Ltd. | Healthcare | 0.50% |

| Oberoi Realty Ltd. | Realty | 0.50% |

| Sun Pharmaceutical Industries Ltd. | Healthcare | 0.49% |

| Punjab National Bank | Financial Services | 0.48% |

| State Bank of India | Financial Services | 0.47% |

| ICICI Bank Ltd. | Financial Services | 0.38% |

| Hindustan Petroleum Corporation Ltd. | Oil, Gas & Consumable Fuels | 0.37% |

| Hindalco Industries Ltd. | Metals & Mining | 0.33% |

| Coforge Ltd. | Information Technology | 0.32% |

| Aditya Birla Fashion and Retail Ltd. | Consumer Services | 0.32% |

| IndusInd Bank Ltd. | Financial Services | 0.32% |

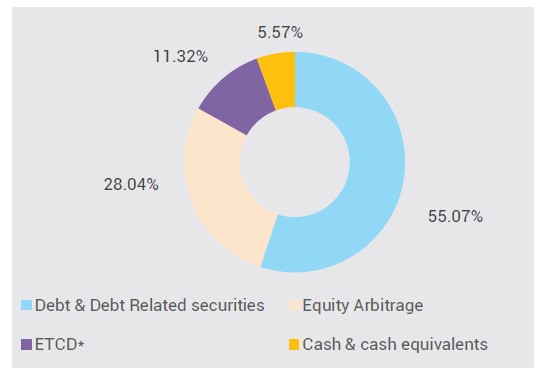

| Others | 75.31% | |

|

Yield to

maturity (YTM)

#

|

7.27%

|

|

Modified

Duration #

|

3.19 years

|

|

Average

Maturity

#

|

4.06 years

|

Macaulay

Duration # |

3.35 years |

| Portfolio Turnover Ratio^ | Equity 0.74 F&O 5.53 Debt 0.20 Comm 0.00 |

| Total Portfolio Turnover Ratio^ | 6.46 |

| # Yield to maturity (YTM), Modified Duration, Average Maturity and Macaulay Duration for Debt Portion. |

|

|

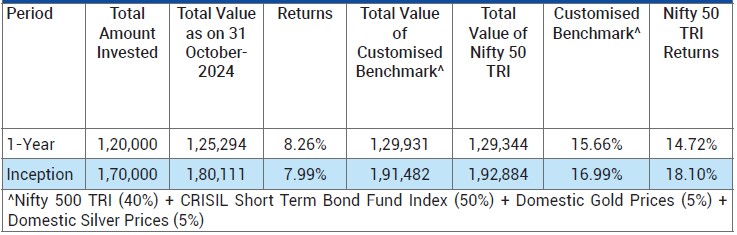

Period

|

Scheme - Regular Plan |

Benchmark^ |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

8.06% |

10,808 |

21.52% |

12,158 |

28.30% |

12,839 |

|

Since Inception - Regular Plan |

7.69% |

11,059 |

18.68% |

12,621 |

22.53% |

13,180 |

^Nifty 500 TRI (40%) + CRISIL Short Term Bond Fund Index (50%) + Domestic Gold Prices (5%) + Domestic Silver Prices (5%)

For SEBI prescribed standard format for disclosure of Portfolio YTM for Debt Schemes please Click here

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

* Simple Annualized Return.

The scheme is currently managed by Bhavesh Jain (managing this fund from Jun 23, 2023 ), Bharat Lahoti (managing this fund from Jun

23, 2023). Rahul Dedhia (managing this fund from Jul 01, 2024). Amit Vora (managing this fund from Jun 23, 2023). & Ms. Pranavi Kulkarni

(managing this fund from August 01, 2024). Please Click here name of the other schemes currently managed by the Fund

Managers and relevant scheme for performance..

This Product is suitable for investors who are seeking*:

- Income generation from fixed income instruments.

- Capital appreciation from Equity and equity related instruments, Commodities and in units of REITs & InvITs.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors understand that their principal will be at Low to Moderate Risk

Benchmark Riskometer: Nifty 500 TRI (40%) + CRISIL Short

Term Bond Fund Index (50%) + Domestic Gold Prices (5%)

+ Domestic Silver Prices (5%).

Investors understand that their principal will be at Very High Risk