Edelweiss Recently Listed IPO Fund

An open-ended equity scheme following

investment theme of investing in recently

listed 100 companies or upcoming Initial

Public Offer (IPOs)

Note: Edelweiss Maiden Opportunities close ended fund is revised to

Edelweiss Recently Listed IPO Fund and is available from June 29, 2021

Data as on 31st January, 2025

| Investment Objective : The investment objective of the Scheme is to seek to provide capital appreciation by investing in equity and equity related securities of recently listed 100 companies or upcoming Initial Public Offers (IPOs). However, there can be no assurance that the investment objective of the Scheme will be realised. |

|

| Inception Date | 22-Feb-18 |

| Benchmark | NIFTY IPO Index** **With effect from August 14, 2024, The benchmark for Edelweiss Recently Listed IPO Fund has been changed from India Recent 100 IPO Index to NIFTY IPO Index. |

| Fund Managers Details | Mr. Bharat Lahoti Experience 18 years Managing Since 22-Feb-18 Mr. Bhavesh Jain Experience 16 years Managing Since 22-Feb-18 |

| Minimum Investment Amount | Rs. 100/- and in multiples of Re. 1/- |

| Additional investment amount | Rs. 100/- and in multiples of Re. 1/- thereafter |

| Exit Load | Upto 180 days : 2% After 180 days : Nil |

| Total Expense Ratios~: | Regular Plan 2.29% Direct Plan 1.03% |

| Month End AUM |

Rs. 907.40 Crore

|

| Monthly Average AUM |

Rs. 955.06 Crore

|

| Direct Plan IDCW Option |

25.5674

|

| Direct Plan Growth Option |

25.5661

|

| Regular Plan IDCW Option |

27.2120

|

| Regular Plan Growth Option |

27.2120

|

| (as on January 31, 2025) |

|

Name of Instrument

|

Industry

|

% to Net

Assets

|

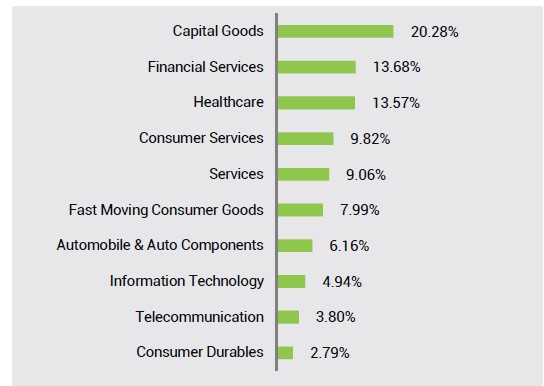

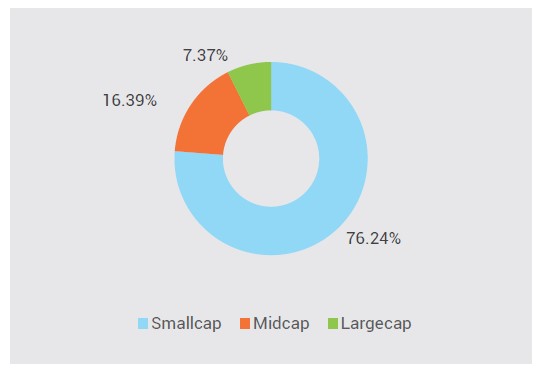

| Equities | 95.70% | |

| Bharti Hexacom Ltd. | Telecommunication | 4.54% |

| Jyoti CNC Automation Ltd. | Capital Goods | 4.27% |

| Sagility India Ltd. | Information Technology | 3.90% |

| Bajaj Housing Finance Ltd. | Financial Services | 3.72% |

| TBO Tek Ltd. | Consumer Services | 3.65% |

| Innova Captab Ltd. | Healthcare | 3.60% |

| NTPC Green Energy Ltd. | Power | 3.55% |

| Premier Energies Ltd. | Capital Goods | 3.53% |

| Hyundai Motor India Ltd. | Automobile & Auto Components | 3.33% |

| Vishal Mega Mart Ltd | Consumer Services | 3.21% |

| Happy Forgings Ltd. | Capital Goods | 3.08% |

| Swiggy Ltd. | Consumer Services | 2.89% |

| Aadhar Housing Finance Ltd. | Financial Services | 2.76% |

| Azad Engineering Ltd. | Capital Goods | 2.56% |

| Inventurus Knowledge Solutions Ltd. | Information Technology | 2.39% |

| AWFIS Space Solutions Ltd. | Services | 2.37% |

| Go Digit General Insurance Ltd. | Financial Services | 2.30% |

| Doms Industries Ltd. | Fast Moving Consumer Goods | 2.18% |

| Ask Automotive Ltd. | Automobile & Auto Components | 2.04% |

| Acme Solar Holdings Ltd. | Financial Services | 1.97% |

| JSW Infrastructure Ltd. | Services | 1.97% |

| Sai Life Sciences Ltd | Healthcare | 1.92% |

| Bikaji Foods International Ltd. | Fast Moving Consumer Goods | 1.90% |

| Indegene Ltd. | Healthcare | 1.67% |

| International Gemmological Inst Ind Ltd. | Services | 1.64% |

| Bansal Wire Industries Ltd. | Capital Goods | 1.53% |

| P N Gadgil Jewellers Ltd. | Consumer Durables | 1.45% |

| Kaynes Technology India Ltd. | Capital Goods | 1.43% |

| Apeejay Surrendra Park Hotels Ltd. | Consumer Services | 1.38% |

| Ceigall India Ltd. | Construction | 1.33% |

| Emcure Pharmaceuticals Ltd. | Healthcare | 1.27% |

| Protean eGov Technologies Ltd. | Information Technology | 1.26% |

| Jupiter Life Line Hospitals Ltd. | Healthcare | 1.11% |

| Carraro India Ltd. | Automobile & Auto Components | 1.04% |

| Kross Ltd. | Automobile & Auto Components | 1.03% |

| Concord Biotech Ltd. | Healthcare | 1.02% |

| Unimech Aerospace And Manufacturing Ltd. | Capital Goods | 1.01% |

| KFIN Technologies Pvt Ltd. | Financial Services | 1.00% |

| Samhi Hotels Ltd. | Consumer Services | 0.94% |

| Baazar Style Retail Ltd. | Consumer Services | 0.93% |

| Medi Assist Healthcare Services Ltd. | Financial Services | 0.86% |

| Waaree Energies Ltd. | Capital Goods | 0.85% |

| JNK India Ltd. | Capital Goods | 0.76% |

| Sanathan Textiles Ltd. | Textiles | 0.69% |

| Godavari Biorefineries Ltd. | Fast Moving Consumer Goods | 0.69% |

| ECOS (India) Mobility & Hospitality Ltd. | Services | 0.64% |

| Juniper Hotels Ltd. | Consumer Services | 0.61% |

| Gopal Snacks Ltd. | Fast Moving Consumer Goods | 0.59% |

| India Shelter Finance Corporation Ltd. | Financial Services | 0.55% |

| DAM Capital Advisors Ltd. | Financial Services | 0.39% |

| Akums Drugs And Pharmaceuticals Ltd. | Healthcare | 0.27% |

| Laxmi Dental Ltd. | Healthcare | 0.06% |

| National Stock Exchange of India Ltd. | Financial Services | 0.05% |

| Stanley Lifestyles Ltd. | Consumer Durables | 0.02% |

| Cash & Other Receivables | 3.97% | |

| Cash & Cash Equivalent | 3.27% | |

| TREPS_RED_03.02.2025 | 0.70% | |

| Debt | 0.33% | |

| Government of India | SOV | 0.33% |

| Grand Total | 100.00% |

|

Std.deviation

|

18.14%

|

|

Sharpe

Ratio**

|

0.14

|

|

Beta

|

0.91

|

|

Active

Share

|

43.08%

|

|

Information Ratio

|

0.39

|

|

Total stocks

in portfolio

|

53

|

|

Top 10 stocks

|

37.30%

|

| Portfolio Turnover Ratio^ | Equity: 0.80 F&O:0.24 |

| Total Portfolio Turnover Ratio^ | 1.04 |

|

Net Equity

|

97.70%

|

| **Risk free rate of return (FIMMDA Overnight MIBOR) 6.65% 1. Standard deviation and Sharpe ratio are annualized. 2. ^Lower of sales or purchase divided by average AUM for last rolling 12 months. 3. Active share is the fraction of a fund's portfolio holdings that deviate from the benchmark index. Source: Bloomberg. 4. Information ratio has been calculated using daily returns over a period of 3 years. |

|

|

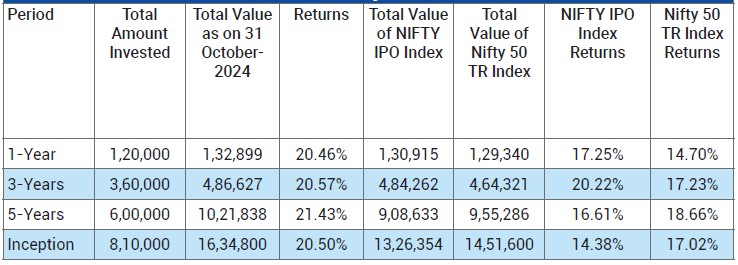

Period

|

Scheme - Regular Plan |

Benchmark (NIFTY IPO Index)** |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

11.82% |

11,186 |

3.71% |

10,372 |

9.55% |

10,958 |

| 3 Years | 9.21% |

13,027 |

6.85% |

12,202 |

12.01% |

14,058 |

|

5 years |

19.13% |

24,022 |

10.07% |

16,165 |

15.80% |

20,844 |

|

Since Inception - Regular Plan |

14.47% |

25,567 |

7.64% |

16,678 |

13.86% |

24,639 |

Past performance may or may not be sustained in future and should not be used as a basis for

comparison with other investments.* CAGR Return.

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are

of Regular Plan of Edelweiss Recently Listed IPO Fund. Returns are for Growth Option only. In case

the start/end date is non business day, the NAVof previous day is used for computation.

2. The scheme is currently managed by Mr. Bharat Lahoti (Managing since Feb 22, 2018) and Mr. Bhavesh

Jain (Managing since Feb 22, 2018). Please Click here for name of

the other schemes currently managed by the Fund Managers and relevant scheme for performance.

3. **With effect from August 14, 2024, The benchmark for Edelweiss Recently Listed IPO Fund has been changed from India Recent 100 IPO Index to NIFTY IPO Index.

4. Note: Edelweiss Maiden Opportunities Fund Series 1 (a closed ended scheme) was converted into Edelweiss Recently Listed IPO Fund (an open ended scheme) and is now open for investment effective from June 29, 2021.

For performance of Direct Plan please

click here

This Product is suitable for investors who are seeking*:

- Long-term capital growth.

- Investment in equity and equity-related securities recently listed 100 companies or upcoming Initial Public Offer (IPOs)

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: India Recent 100 IPO Index

Note: Edelweiss Maiden Opportunities Fund Series 1 (a closed ended scheme) was converted into Edelweiss Recently Listed IPO Fund (an open ended scheme) and is now open for investment effective from June 29, 2021.