Edelweiss US Value Equity Off-Shore Fund

An open ended fund of fund scheme investing in JPMorgan Funds – US Value Fund

Data as on 31st January, 2025

| Investment Objective : The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds- US Value Fund, an equity fund which invests primarily in a value style biased portfolio of US companies. However, there can be no assurance that the investment objective of the Scheme will be realised. |

|

| Inception Date | 7-Aug-13 |

| Benchmark | Russell 1000 TR Index |

| Fund Managers Details | Mr. Bhavesh Jain Experience 16 years Managing Since 27-Sep-2019 Mr. Bharat Lahoti Experience 18 years Managing Since 01-Oct-2021 |

| Minimum Investment Amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter |

| Additional investment amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter |

| Exit Load |

|

| Total Expense Ratios~: | Regular Plan 2.33% Direct Plan 1.42% This includes expense of underlying fund Expense of underlying fund - 0.75% |

| Month End AUM |

Rs. 164.46 Crore

|

| Monthly Average AUM |

Rs. 154.58 Crore

|

| Regular Plan Growth Option |

33.2961

|

| Direct Plan Growth Option |

36.6537

|

| (as on January 31, 2025) |

|

Name of Instrument

|

Exposure

|

| WELLS FARGO & CO COMMON STOCK USD 1.666 | 3.37% |

| UNITEDHEALTH GROUP INC COMMON STOCK USD 0.01 | 2.70% |

| BANK OF AMERICA CORP COMMON STOCK USD 0.01 | 2.51% |

| BERKSHIRE HATHAWAY INC COMMON STOCK USD 0.0033 | 2.46% |

| CONOCOPHILLIPS COMMON STOCK USD 0.01 | 2.14% |

| CHARLES SCHWAB CORP/THE COMMON STOCK USD 0.01 | 2.10% |

| MORGAN STANLEY COMMON STOCK USD 0.01 | 2.10% |

| CSX CORP COMMON STOCK USD 1 | 1.97% |

| CHEVRON CORP COMMON STOCK USD 0.75 | 1.96% |

| LOWE'S COS INC COMMON STOCK USD 0.5 | 1.87% |

| ANALOG DEVICES INC COMMON STOCK USD 0.167 | 1.81% |

| CARRIER GLOBAL CORP COMMON STOCK USD 0.01 | 1.79% |

| MCDONALD'S CORP COMMON STOCK USD 0.01 | 1.79% |

| AIR PRODUCTS AND CHEMICALS INC COMMON STOCK USD 1 | 1.78% |

| EATON CORP PLC COMMON STOCK USD 0.01 | 1.69% |

| ABBVIE INC COMMON STOCK USD 0.01 | 1.63% |

| TEXAS INSTRUMENTS INC COMMON STOCK USD 1 | 1.63% |

| AMERICAN EXPRESS CO COMMON STOCK USD 0.2 | 1.63% |

| EXXON MOBIL | 1.62% |

| DOVER CORP COMMON STOCK USD 1 | 1.60% |

| TJX COS INC/THE COMMON STOCK USD 1 | 1.60% |

| HOME DEPOT INC/THE COMMON STOCK USD 0.05 | 1.57% |

| MICROSOFT CORP COMMON STOCK USD 0.00000625 | 1.54% |

| BRISTOL-MYERS SQUIBB CO COMMON STOCK USD 0.1 | 1.51% |

| UNITED PARCEL SERVICE INC COMMON STOCK USD 0.01 | 1.49% |

| FISERV INC COMMON STOCK USD 0.01 | 1.48% |

| WALMART INC COMMON STOCK USD 0.1 | 1.45% |

| EOG RESOURCES INC COMMON STOCK USD 0.01 | 1.41% |

| VULCAN MATERIALS CO COMMON STOCK USD 1 | 1.36% |

| JOHNSON & JOHNSON COMMON STOCK USD 1 | 1.30% |

| Grand Total | 54.86% |

| Others | 45.14% |

JPMorgan Funds- US Value Fund as on 31st December, 2024

|

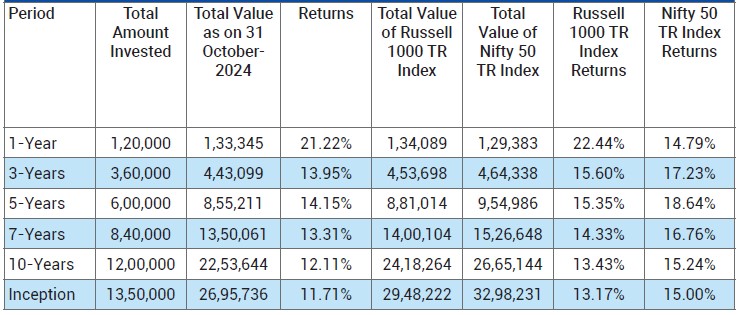

Period

|

Scheme - Regular Plan |

Benchmark (Russell 1000 Index) |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

21.64% |

12,170 |

24.59% |

12,466 |

9.55% |

10,958 |

|

3 Year |

12.11% |

14,095 |

13.41% |

14,593 |

12.01% |

14,058 |

| 5 Year | 13.38% |

18,748 |

14.44% |

19,647 |

15.80% |

20,844 |

|

10 Year |

11.15% |

28,809 |

13.18% |

34,524 |

11.66% |

30,174 |

|

Since Inception - Edelweiss US Value Equity Off-Shore Fund |

11.03% |

33,296 |

13.07% |

41,026 |

14.80% |

48,875 |

Past performance may or may not be sustained in future and

should not be used as a basis for

comparison with other investments. * CAGR Return.

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are

of Regular Plan of Edelweiss US Value Equity Off-Shore Fund. Returns are for Growth Option only. Since

Inception returns are calculated on Rs. 10/- invested at inception of the scheme. In case the

start/end date is non business day, the NAV of previous day is used for computation.

2. The scheme is currently managed by Mr. (Managing Bhavesh Jain this fund from September 27, 2019) &

Mr. Bharat Lahoti (Managing this fund from October 01, 2021).

Please Click here for name of the other

schemes currently managed by the Fund Managers and relevant scheme for performance.

3. Please note that the scheme is acquired from JPMorgan mutual fund on and from the close of business

hours of November 25, 2016, hence disclosure requirement vide SEBI Circular no.

SEBI/HO/IMD/DF3/CIR/P/2018/69 dated April 12, 2018 on performance disclosure post consolidation/

Merger of Schemes, prior to acquisition date, is not provided.

For performance of Direct Plan please

click here

This Product is suitable for investors who are seeking*:

- Long term capital appreciation

- Investments predominantly in JPMorgan Funds – US Value Fund, an equity fund which invests primarily in a value style biased portfolio of US companies

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: Russell 1000 TR Index