Edelweiss ELSS Tax saver Fund

An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit

Data as on 31st January, 2025

| Investment Objective : The primary objective of the Scheme is to generate long-term capital appreciation with an option of periodic payouts at the end of lock in periods from a portfolio that invests predominantly in equity and equity related instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. |

|

| Inception Date | 30-Dec-08 |

| Benchmark | Nifty 500 TR Index |

| Fund Managers Details | Mr. Ashwani Agarwalla Experience 18 years Managing Since 15-Jun-22 Mr. Trideep Bhattacharya Experience 25 years Managing Since 24-Dec-21 Mr. Raj Koradia Experience 7 years Managing Since 01-Aug-24 |

| Minimum Investment Amount | Rs. 500/- per application & in multiples of Re. 500/- thereafter |

| Additional investment amount | Rs. 500/- per application & in multiples of Re. 500/- thereafter |

| Exit Load | Nil |

| Total Expense Ratios~: | Regular Plan 2.35% Direct Plan 0.78% |

| Month End AUM |

Rs. 383.35 Crore

|

| Monthly Average AUM |

Rs. 387.14 Crore

|

| Regular Plan Growth Option |

103.4800

|

| Regular Plan IDCW Option |

27.7000

|

| Direct Plan Growth Option |

121.4700

|

| Direct Plan IDCW Option |

41.0700

|

| (as on January 31, 2025) |

|

Name of Instrument

|

Industry

|

% to Net

Assets

|

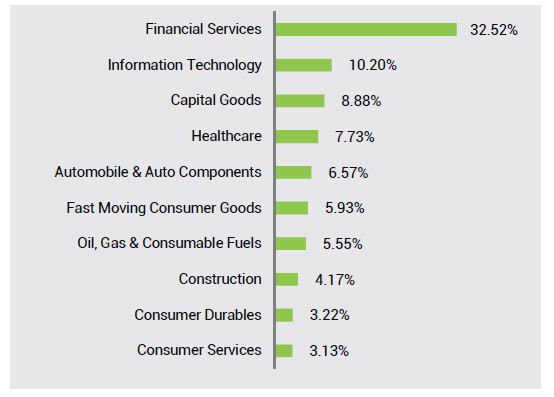

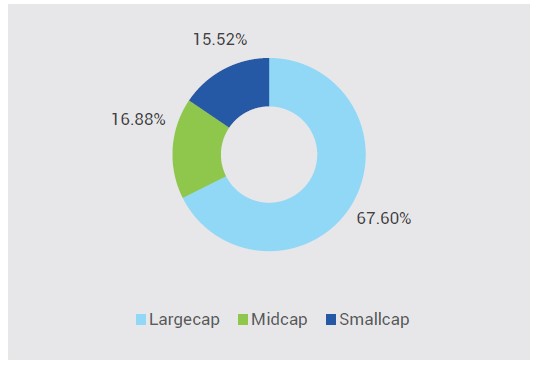

| Equities | 96.93% | |

| HDFC Bank Ltd. | Financial Services | 6.44% |

| ICICI Bank Ltd. | Financial Services | 5.33% |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | 4.59% |

| Infosys Ltd. | Information Technology | 3.32% |

| Bharti Airtel Ltd. | Telecommunication | 3.11% |

| Larsen & Toubro Ltd. | Construction | 3.11% |

| State Bank of India | Financial Services | 3.01% |

| Trent Ltd. | Consumer Services | 2.29% |

| Sun Pharmaceutical Industries Ltd. | Healthcare | 2.28% |

| Tata Consultancy Services Ltd. | Information Technology | 1.98% |

| BSE Ltd. | Financial Services | 1.88% |

| Ultratech Cement Ltd. | Construction Materials | 1.87% |

| Axis Bank Ltd. | Financial Services | 1.78% |

| ITC Ltd. | Fast Moving Consumer Goods | 1.76% |

| Bharat Electronics Ltd. | Capital Goods | 1.68% |

| NTPC Ltd. | Power | 1.55% |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | 1.48% |

| Tech Mahindra Ltd. | Information Technology | 1.47% |

| Mahindra & Mahindra Ltd. | Automobile & Auto Components | 1.40% |

| Karur Vysya Bank Ltd. | Financial Services | 1.36% |

| Bikaji Foods International Ltd. | Fast Moving Consumer Goods | 1.34% |

| Power Finance Corporation Ltd. | Financial Services | 1.25% |

| Muthoot Finance Ltd. | Financial Services | 1.20% |

| Multi Commodity Exchange Of India Ltd. | Financial Services | 1.19% |

| PB Fintech Ltd. | Financial Services | 1.19% |

| Max Healthcare Institute Ltd. | Healthcare | 1.12% |

| Zensar Technologies Ltd. | Information Technology | 1.10% |

| Samvardhana Motherson International Ltd. | Automobile & Auto Components | 1.08% |

| Hindalco Industries Ltd. | Metals & Mining | 1.08% |

| Coforge Ltd. | Information Technology | 1.02% |

| Shriram Finance Ltd. | Financial Services | 1.02% |

| SBI Life Insurance Company Ltd. | Financial Services | 1.00% |

| HCL Technologies Ltd. | Information Technology | 0.99% |

| Torrent Pharmaceuticals Ltd. | Healthcare | 0.99% |

| Concord Biotech Ltd. | Healthcare | 0.99% |

| Cholamandalam Investment & Fin Co Ltd. | Financial Services | 0.98% |

| Mphasis Ltd. | Information Technology | 0.90% |

| Titan Company Ltd. | Consumer Durables | 0.86% |

| Jyoti CNC Automation Ltd. | Capital Goods | 0.85% |

| Coal India Ltd. | Oil, Gas & Consumable Fuels | 0.83% |

| Indian Bank | Financial Services | 0.82% |

| Kaynes Technology India Ltd. | Capital Goods | 0.78% |

| Bank of Baroda | Financial Services | 0.77% |

| Creditaccess Grameen Ltd. | Financial Services | 0.72% |

| KEI Industries Ltd. | Capital Goods | 0.71% |

| Brigade Enterprises Ltd. | Realty | 0.71% |

| Hindustan Petroleum Corporation Ltd. | Oil, Gas & Consumable Fuels | 0.69% |

| Power Mech Projects Ltd. | Construction | 0.69% |

| India Shelter Finance Corporation Ltd. | Financial Services | 0.68% |

| Bharat Heavy Electricals Ltd. | Capital Goods | 0.68% |

| TVS Motor Company Ltd. | Automobile & Auto Components | 0.67% |

| Persistent Systems Ltd. | Information Technology | 0.67% |

| Titagarh Rail Systems Ltd. | Capital Goods | 0.67% |

| UNO Minda Ltd. | Automobile & Auto Components | 0.66% |

| Bajaj Finance Ltd. | Financial Services | 0.64% |

| Voltas Ltd. | Consumer Durables | 0.63% |

| Home First Finance Company India Ltd. | Financial Services | 0.61% |

| JB Chemicals & Pharmaceuticals Ltd. | Healthcare | 0.60% |

| Maruti Suzuki India Ltd. | Automobile & Auto Components | 0.60% |

| Cipla Ltd. | Healthcare | 0.57% |

| IndusInd Bank Ltd. | Financial Services | 0.50% |

| Godrej Properties Ltd. | Realty | 0.49% |

| Jubilant Ingrevia Ltd. | Chemicals | 0.49% |

| ICICI Lombard General Insurance Co. Ltd. | Financial Services | 0.49% |

| Balkrishna Industries Ltd. | Automobile & Auto Components | 0.46% |

| Lupin Ltd. | Healthcare | 0.46% |

| Tata Motors Ltd. | Automobile & Auto Components | 0.46% |

| ABB India Ltd. | Capital Goods | 0.45% |

| NTPC Green Energy Ltd. | Power | 0.42% |

| Havells India Ltd. | Consumer Durables | 0.42% |

| Astral Ltd. | Capital Goods | 0.41% |

| Siemens Ltd. | Capital Goods | 0.40% |

| Alembic Pharmaceuticals Ltd. | Healthcare | 0.40% |

| CG Power and Industrial Solutions Ltd. | Capital Goods | 0.39% |

| P I INDUSTRIES LIMITED | Chemicals | 0.38% |

| The Phoenix Mills Ltd. | Realty | 0.37% |

| APL Apollo Tubes Ltd. | Capital Goods | 0.36% |

| Radico Khaitan Ltd. | Fast Moving Consumer Goods | 0.35% |

| P N Gadgil Jewellers Ltd. | Consumer Durables | 0.33% |

| Cyient DLM Ltd. | Capital Goods | 0.32% |

| Dixon Technologies (India) Ltd. | Consumer Durables | 0.32% |

| Jio Financial Services Ltd. | Financial Services | 0.31% |

| IPCA Laboratories Ltd. | Healthcare | 0.30% |

| Canara Bank | Financial Services | 0.29% |

| Ajanta Pharma Ltd. | Healthcare | 0.28% |

| Netweb Technologies India Ltd. | Information Technology | 0.28% |

| JSW Energy Ltd. | Power | 0.25% |

| Oil India Ltd. | Oil, Gas & Consumable Fuels | 0.21% |

| ITC Hotels Ltd. | Consumer Services | 0.06% |

| Vishal Mega Mart Ltd | Consumer Services | 0.04% |

| Cash & Other Receivables | 3.07% | |

| TREPS_RED_03.02.2025 | 2.62% | |

| Cash & Cash Equivalent | 0.45% | |

| Grand Total | 100.00% |

|

Std.deviation

|

13.32%

|

|

Sharpe

Ratio**

|

0.48

|

|

Beta

|

0.94

|

|

Active

Share

|

46.12%

|

|

Information Ratio

|

-0.42

|

|

Total stocks

in portfolio

|

90

|

|

Top 10 stocks

|

35.46%

|

|

Net Equity

|

96.94%

|

|

Portfolio Turnover Ratio^

|

Equity 0.25

F&O 0.00 |

| Total Portfolio Turnover Ratio^ |

0.25

|

| **Risk free rate of return (FIMMDA Overnight MIBOR ) 6.65% 1. Standard deviation and Sharpe ratio are annualized. 2. ^ Lower of sales or purchase divided by average AUM for last rolling 12 months. 3. Active share is the fraction of a fund's portfolio holdings that deviate from the benchmark index. Source: Bloomberg. 4. Information ratio has been calculated using daily returns over a period of 3 years. |

|

|

Period

|

Scheme - Regular Plan |

Benchmark (Nifty 500 TR Index) |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

12.63% |

11,266 |

10.03% |

11,006 |

9.55% |

10,958 |

|

3 Year |

13.05% |

14,453 |

14.24% |

14,916 |

12.01% |

14,058 |

| 5 Year | 16.13% |

21,140 |

18.16% |

23,054 |

15.80% |

20,844 |

|

10 Year |

11.18% |

28,897 |

12.89% |

33,663 |

11.66% |

30,174 |

|

Since Inception - Regular Plan |

15.62% |

1,03,480 |

16.20% |

1,12,063 |

15.05% |

95,600 |

Past performance may or may not be sustained in future and should not be used as a basis for

comparison with other investments. * CAGR Return.

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are of Regular Plan of Edelweiss ELSS Tax saver Fund (Tax Savings). Returns are for Growth Option only. In case the start/end date is non business day, the NAV of previous day is used for computation.

2. The scheme is currently managed by Mr. Ashwani Agarwalla (Managing since June 15, 2022) & Mr. Trideep Bhattacharya (Managing since December 24, 2021). & Mr. Raj Koradia (managing this fund from August 01, 2024). Please Click here for name of the other schemes currently managed by the Fund Managers and relevant scheme for performance.

For performance of Direct Plan please

click here

This Product is suitable for investors who are seeking*:

- To create wealth in the long term

- Investment in equity and equity-related securities that will be locked-in for the first three years.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: Nifty 500 TRI

.jpg)